The Yakezie Carnival is brought to you to by the Yakezie network of personal finance bloggers.

The Yakezie Carnival is brought to you to by the Yakezie network of personal finance bloggers.

Lindy @ Minting Nickels writes When Is The Ideal Time To Buy Gold? – Gold is often thought of as the ultimate symbol of wealth. People have been chasing it forever, and wars have been fought over it.

Jester @ The Ultimate Juggle writes Fairness In Spending On Kids – When I first heard the phrase (work smarter, not harder), I dismissed it as business jargon for (work harder for us with no extra pay).

krantcents @ KrantCents writes Do You Plan or Plan to Fail? – I plan because I do not plan to fail! If you have goals, you need a plan to make it happen. A budget is a form of a plan. Why budget? A budget is supposed to help you achieve your financial goals.

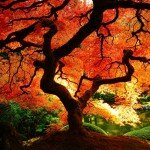

Minimalist @ Minimalist Finance writes Save Money on Heating This Fall – There’s no doubting that fall has descended upon the Western world. The days are becoming shorter, the leaves are falling off of the trees, and there’s a chill in the air that wasn’t around just a month ago.

SFB @ Simple Finance Blog writes Concerns that Parents should think about before cosigning a Loan – There comes a time in your life when you may be requested to co-sign on a loan.

Tushar @ Finance TUBE writes 3 Tips To Prepare Your Family For Cost of Aging – Admitting that your loved one is getting older is hard but not as hard to figure out our family will afford the overwhelming cost associated with aging. From hospital care to doctor’s visits, caring for your loved one Here are three tips how to financially prepare: Firstly learn more about financial planning.

LaTisha @ Young Finances writes How Can I Use Credit Wisely? – Credit cards are not evil. You can build a healthy credit history. Use credit to borrow, get better car insurance rates and potentially secure employment.

Lauren @ L Bee and the Money Tree writes My New Net Worth – Should I count my home’s value in my net worth?

Tushar @ Start Investing Money writes Saving From a Young Age – There is a big difference between saving on behalf of your kids and teaching them good savings habits so they can start saving on their own. Many parents want to put something away for their children’s future – perhaps to help them through college for example.

Debt Guru @ Debt Free Blog writes Security for Less: Cutting Your Car Insurance Costs – It’s time to research options and get the most out of your insurance policy. Here are five tips to cut car insurance costs without missing out on coverage.

Debt Guru @ Debt Free Blog writes Security for Less: Cutting Your Car Insurance Costs – It’s time to research options and get the most out of your insurance policy. Here are five tips to cut car insurance costs without missing out on coverage.

Hank @ Money Q&A writes Are You Losing The Financial Game Of Life? – Are you losing in the financial game of life? If you answered yes, you’re not alone. In 2008, 1 in 10 workers were made redundant.

Jacob @ AllPersonalFinance writes Tax Season Is Around the Corner: Six Things To Do Today To Prepare – Many people do not start thinking about their taxes until April 15 approaches. However, it is never too early to start preparing for the next tax season. Preparing early can help you save a lot of time and stress. Read about these six tips that will help you prepare for tax season!

Ted Jenkin @ Your Smart Money Moves writes Let Me Tell You How It Was When I Was A Kid – Remember. Remember how thoroughly annoyed you got when your parents sat you down for that tongue lashing telling you about how spectacular your life is today

Mr. Frenzy @ Frenzied Finances writes What High School Never Taught You (And Should Have): What is a Bond? – High school teaches you algebra, english and history – but it doesn’t teach you finance! Read here to learn all about a bond.

Ryan @ Cash Money Life writes Income vs Wealth – And What it Means For You – There is a big distinction when comparing income vs wealth. Income is how much you earn, wealth is how much you keep. Make your money work for you.

Eva Baker @ TeensGotCents writes The Envelope System – An Update – I use the envelope system to budget my money. I have been working very hard to save up for a car, college and retirement – here’s an update!

Suba @ Broke Professionals writes Money Terms You Need to Know – Read these critical money terms that you should know to be knowledgeable in the personal financial world.

Luke @ Learn Bonds writes Why The Recent Drop In Interest Rates May Not Be What You Think – The factors that contributed to Wednesdays drop in Treasury yield may have more to do than just the Fed and quantitative easing.

Tushar Mathur @ Everything Finance writes Three Tips to Save Money on Halloween This Year – If you couldn’t already tell by the store displays and kids already running around in their costumes, Halloween is only a month a way.

Rich @ Growing Money Smart writes What is Debt Ratio? – What is Debt Ratio? This post defines the ratio and give a take on what if the ratio is a high number

Don @ Money Reasons writes Do I Have Brilliant Ideas on Helping the Econony or No? – These are some ideas I have for helping the economy. While I think they are original, I wonder if they are being considered already within the government?

Crystal @ Married (with Debt) writes Remembering the “Pay Yourself First” Rule – Before my husband and I went self-employed, I had a 401k and hubby had a pension plan. Those went bye-bye when we did. Now we are adding more options.

Roger the Amateur Financier @ The Amateur Financier writes 4 Sources of Income in Retirement – A guide to several sources of income during retirement, including social security, pensions, personal savings and investments, and working part-time,

Jim @ Save College Money writes saving for college goal – After a long talk with my parents, we’ve determined that I’m not going to have enough for the college education that I’m interested in. While my parents have been saving for my college education since I was born, the projected amount that will be needed for college will still fall short… Read my plans!

CAPI @ Creating a Passive Income writes Staying Safe: The Pros and Cons of Safety Deposit Boxes – People are doing all sorts of things to keep their valuables safe. Today we’ll take a look at safety deposit boxes to establish whether they are efficient.

SBB @ Simple Budget Blog writes The Freelancer’s Budget – So you’ve decided to quit your job and turn your hobby into a freelance career! Read here for tips on how to set up a budget when you’re a freelancer.

Brent @ PersonalFinance-Tips writes 5 Secrets to Breaking Your Bad Financial Habits – If you want to gain control over your finances and break unhealthy habits, follow the following five tips. 1. Take Emotion Out of the Equation Some people spend a lot of money because they associate certain items with an emotion or experience. For example, a person may buy dolls because she associates them with her childhood and happy memories.

IMB @ Investing Money writes The Big Question for Investors-Inflation or Deflation – Investors are scratching their heads asking: “What in the world is going on? What is real? What should I believe?” This is the big question on inflation.

Wayne @ Young Family Finance writes Minding Your Business: What Type of Corporation are You? – Is your business a nonprofit, sole proprietorship, or corporation? If you’re starting a business, it could be important! Find out here.

Mrs. Accountability @ Out of Debt Again writes Budgeting in a Move – After recently helping a family member move, I realized just how costly some moving products are.

Tushar @ Earn More and Save writes 3 Things You Need to Know About Paying Off Debt – You’re on a mission to earn more and save as much as possible. There is only one thing standing in your way. Debt. To build a solid financial foundation you first need to free yourself from the burden of debt.

Daisy @ Suburban Finance writes Getting Fit Without Spending a Fortune – Getting in shape without a gym membership is easy. Save money and slim down with some of our tips.

Daisy @ Suburban Finance writes Getting Fit Without Spending a Fortune – Getting in shape without a gym membership is easy. Save money and slim down with some of our tips.

Cat Alford @ Budget Blonde writes Make Your Home Fancy and Modern On A Budget – If you want to modernize your home on a budget, here are some great tips to get that bright, airy feel you want without breaking the bank.

Don @ MoneySmartGuides writes 5 Autumn Home Maintenance Tips – With winter approaching, it’s important to get your house in order for the cold weather. Here are some autumn home maintenance tips for you to implement.

Bargain Babe @ BargainBabe.com writes Alternative Ways to Earn Income – Dedicated – Have you heard those radio add or seen the television commercials depicting individuals claiming they need help to “sell my gold”, “get cash now” or sell my diamond?” If you listen to the radio at all…

Cindy @ MidLife Finance writes Should You Keep A Second Car – Or Not? – Should we keep both? For that matter, if you belong to a two-worker household, should you?

Mike @ Personal Finance Journey writes Money saving tips for the Laundry – Simple and easy Money Saving tips for the laundry. It doesn’t have to expensive to keep your clothes clean!

Maria @ The Money Principle writes Frugality or folly: home baking – Is home baking frugality or folly? I say that naking your own bread makes you frugal artist; what do you think?

Corey @ 20s Finances writes 6 Tips for Recent Grads to be Smarter With Their Money – Everyone knows that after graduation, there’s a lot you need to do. One of the most important things you can do is learn to be smart with your money. Whether you already have a job, or you’re looking for one after school is out, here are some money tips to help you stay ahead.

Crystal @ Budgeting in the Fun Stuff writes Things I Don’t Miss About My Last Day Job – Someone asked me if I missed having a “real” day job. Honestly, there are things I miss about it, but those are outweighed by the things I don’t miss at all.

Emily @ Evolving Personal Finance writes FPU: I Get to See What All the Fuss Is About! – I am serving as a table host for Dave Ramsey’s Financial Peace University, but I don’t agree with his teachings!

Dividend Growth Investor @ Dividend Growth Investor writes Long Term Dividend Growth Investing – The only thing that is constant in life is change. The world of dividend investing closely follows this eternal truth as well.

Irfan @ Everything About Investment writes Safeguarding Your Real Estate Investment – Investing in the real estate markets has become an increasingly viable option, given the persistence of recovery in the housing markets. Ordinary people are buying second homes to rent or renovate, while serious investors are returning to real estate as a potentially lucrative basis for their investment. For those who choose to invest in real estate, safeguarding and maintaining the value of the investment is essential. Homes can deteriorate if left unchecked, and apartments can easily fall to r

Mr. Utopia @ Personal Finance Utopia writes Relocate to Improve Personal Finances? – Would you move simply to improve the health of your personal finances? My family is considering relocating for this exact reason. Find out why.

Daniel @ Sweating The Big Stuff writes When Was The Last Time You Wrote A Check? – I rarely write checks these days with easier alternatives like PayPal abound, so it was surprising that the most recent check I cut was to a friend.

FI Pilgrim @ FI Journey writes How To Create A Strategic Plan For Your Finances – If you have ever been in business, you have probably been exposed to a strategic plan in some form. Here is how to create a strategic plan for yourself!

FI Pilgrim @ FI Journey writes How To Create A Strategic Plan For Your Finances – If you have ever been in business, you have probably been exposed to a strategic plan in some form. Here is how to create a strategic plan for yourself!

Barbara Friedberg @ Barbara Friedberg Personal Finance writes 17 Tips For Coping With Money and Life Problems – Money problems? Life problems? Learn actionable solutions to cope with money and life issues.

Monica @ Monica On Money writes Do You Make These 9 Budgeting Mistakes? – We all make mistakes with our budgets, even those who seem to have it all together financially.

Buck @ Buck Inspire writes Why My Podcast Does Not Have Over 300,000 Monthly Downloads Like Entrepreneur On Fire, John Lee Dumas! – A name that has taken the podcasting world by storm is Entrepreneur On Fire’s John Lee Dumas. Recently I was reminded of his amazing story

Joe Saul-Sehy @ www.thefreefinancialadvisor.com writes How I Saved $550 Through Creative Negotiating – Do you have to accept the quoted price for a service? This article demonstrates a simple way to negotiate.

Natalie @ Debt and the Girl writes 20 Truths You Learn in your 20s – I have been reading a great book called 101 Secrets for your Twenties by Paul Angone. It inspired me to come up with my own list of 20 truths that I find to be true since being in my 20s.

Marissa @ Thirty Six Months writes Why I Spent Twice My Budget on My Car – If you have been a reader for a while, you know my insurance woes, and my somewhat questionable driving record. I am not going to dispute that, but I am going to talk about how I ended up spending twice my budget on my car.

Sam @ The New Business Blog writes How to be a Balanced Entrepreneur – When it comes to professions, being an entrepreneur is probably one of the most imbalanced. The reason is that there are extreme highs as an entrepreneur and, occasionally, crushing lows.

Katie @ IRA Basics writes Benefits of a Budget – Budget. It is a dreaded word, not one that instills ideas of grandeur and immense fun. It is also a word that is often neglected, an idea that most of us would rather not think about.

Lily @ Paying Debt Down writes Why Buying the Top Brand’s Stock is almost always a Good Idea – When it comes to things like cars, food, clothing and other products many people go for the top of the line brands, usually without even giving it a second thought. The reason this occurs is because they know that, in most cases, the brand that they are buying either is more reliable, will last longer, tastes better or looks better.

Andrea @ So Over This writes Direction of this Blog, and Getting to Know Me – By now I am sure the faithful have realized that this blog has taken on a considerably different tone in the last month or two. Our fantastic blogger and friend, Andrea, has decided to take some time away from blogging to focus on other avenues of her life.

Hadley @ Epic Finances writes Investment Tips to Reduce your Risk – When it comes to investing one of the best ways to make sure that you end up with a solid portfolio that, year after year, increases in value, is to simply keep your risk as low as possible. Here are some tips for how to do that.

Lenny @ Best Money Saving Blog writes Financial Advice that you Shouldn’t follow, as Recommended by Suze Orman – We ve put together some financial advice that you actually should not follow based on the words and opinions of one of the most respected financial advisors today, Suze Orman.

Daniel @ Make Money Make Cents writes How to Save Even More on Everyday Purchases – Creating a budget has become a normal part of any household to make sure the money coming in is being allocated correctly. This means finding ways to save on everyday purchases in any way possible.

Daniel @ Make Money Make Cents writes How to Save Even More on Everyday Purchases – Creating a budget has become a normal part of any household to make sure the money coming in is being allocated correctly. This means finding ways to save on everyday purchases in any way possible.

Oscar @ Money is the Root writes Are BitCoins as Safe as Regular Money? – Bitcoins are a new form of virtual money that is being used around the world in order to avoid the pitfalls of governments, taxes and banks. While this may be the case, the big question is are they safer than regular money?

Jay @ Daily Fuel Economy Tip writes Testing the Tips – How the Gas Saving Tips actually Measure Up – Unless you live in Siberia and use snowshoes to get around, you are probably aware that gas prices are at an all-time high. You know that, no matter where you look, there are tips for how to save gas, how to increase your MPG and how to save money at the gas pump.

Jack @ Money Saving Ethics writes Credit Mistakes that Older Americans are Making – The cost of healthcare is rising, pensions to supplement Social Security have been going away for quite some time, savings are not growing due to lower interest rates and, most significantly, credit debt has seen a huge rise. Here are some of the biggest mistakes that older Americans are making with credit.

Amy @ Money Mishaps writes Are you Throwing Money Away? If You do These 3 Things, Yes – Science magazine just published a study that found that, if you are poor and also mismanage your money, it is possible that you might be able to make good financial decisions but more than likely you have trapped yourself into a vicious circle and cannot.

Alice Sibley @ Earning My Two Cents writes Coming Clean About Debt – Debt is a taboo subject, let’s come clean about it

Robert @ The College Investor writes Investing When You Have Debt – One of the toughest questions I get asked regularly is how to start investing when you have debt. The reason this is tough is because so many people have unique financial situations that make blanket statements about when to start investing tough. However, over time, I’ve come to find a few truths to investing when you have debt, and I wanted to share them with you.

Christopher @ This That and The MBA writes Manage Debt Before It Manages You – It is important to keep debt at reasonable and manageable levels or we could end up incurring high interest rate charges. Even worse having barely enough money to pay the minimum payments on our credit cards.

Dollar @ Easy Extra Dollar writes Christmas and Budgeting – Once you have your list of gift recipients there are a couple of ways to go about establishing a budget. Perhaps the simplest way is to decide how much you plan to spend on Christmas shopping and divide this amount by the number of gift recipients on your list.

Jefferson @ See Debt Run writes What Is This “Betterment Charge” That An Insurance Company Wants Me to Pay? – If you are in an accident, you may be surprised to learn that insurance companies will charge you a betterment charge for some repairs, leaving you on the hook for paying even if you aren’t at fault.

Matt Becker @ Mom and Dad Money writes Roth IRA as an Emergency Fund – Is it a Good Idea? – The concept of using your Roth IRA as an emergency fund is one I find incredibly interesting, mostly because of the mental or behavioral considerations. From a purely technical standpoint, it can make a lot of sense. But from a behavioral standpoint, it can be dangerous when you start mixing your retirement savings with other purposes. Today I’d like to explore some of the strengths and weaknesses of taking this approach.

Derek Chamberlain @ MoneyAhoy.com writes Car Downsizing – How I Got a Free Corolla – How I downsized from a Camry to a Corolla and got a free car!

Derek Chamberlain @ MoneyAhoy.com writes Car Downsizing – How I Got a Free Corolla – How I downsized from a Camry to a Corolla and got a free car!

Adam @ Money Bulldog writes The Financial Benefits of Volunteer Work – Get yourself familiar with the financial gains that a lot of people wouldn’t expect from volunteer work.

Adam @ Money Rebound writes The Mistakes That Stop Your Savings Account from Building Up – Want to know which habits can cost you money in the long run? Well, it’s time to break loose from them.

Jon Haver @ Pay My Student Loans writes 3 Worst Kinds of Student Loans – Federal loans have certain rights and responsibilities that most students can live with. All in all, you can be pretty safe with them in terms of refinancing, consolidating, and extending your payment time. But you have to pay them back. It’s not a gift.

Brian @ Luke1428 @ Luke1428 writes What’s More Valuable: Short or Long-Term Goals? – Goals provide us with a target to shoot for. Some are short term, others take longer. Which ones are more valuable? The answer shouldn’t surprise you.

Ray @ Squirrelers writes Addicted to New Cell Phones: How Often Do You Upgrade? – Many people can’t wait to upgrade as soon as their contract is up; in some cases, even sooner. I take a different approach!

Colin Williams @ Humble Investors writes Building Wealth Basics – A Presentation – A slide presentation demonstrating how to build wealth in a simple and effective format

Paul @ The Frugal Toad @ The Frugal Toad writes Health Savings Accounts: The Benefits And Possible Retirement Options – Have you heard of the health savings account (HSA)? These accounts have been gaining steam as of late and there are a few reasons why. Before I get into why many people have been opening HSAs, let me explain what they are.

John @ FRUGAL RULES writes Has an Uncertain Stock Market Derailed Your Investment Plan? – If you’ve been following the news the past few weeks it has made it difficult to know what to do with your investment portfolio. The fact is there is always something going on in the news and the best thing is to focus on your investing goals and continue to work on building wealth and growing your retirement portfolio.

Pauline @ Make Money Your Way writes Side hustle series: How I make money flipping phones – This is a guest post from Stephen he will explain how he make money flipping phones.

Pauline @ Reach Financial Independence writes The case for earning more – On the earn more, spend less equation, I strongly stand on the earn more side, because spending less is finite.

Grayson @ Debt Roundup writes When Opportunity Knocks – I had an opportunity to score a new to me Jeep Wrangler. I thought about it and ended up getting a used auto loan. There are some reasons why and I lay them out here.

DPF @ Digital Personal Finance writes 3 Questions to Ask When Aiming For Financial Success – Quite often, we need to ask the right questions up front in order to achieve success, and personal finance is no different

Jerry @ Repaid.org writes 5 Top Financial Rules to Remain Debt-Free – Getting out of debt is your first challenge, but staying out of debt is just as important. We look at 5 top ways to stay the course.

Little House @ Little House in the Valley writes Could a Financial Manager for ADHD Clients Be a Trendy Job in the Future? – I recently read an article targeted toward ADHD adults, “Managing Your Money When You Have ADHD.” The article listed a few solutions for forgetful, distracted folks, but it made me think about how this could lead to a potential niche job market; Financial Managers for ADHD clients.

Steve @ 2012 to 2013 Taxes writes Tax Tips By Consumer Reports On Lowering Your Expenses – Filing of federal income tax returns by businesses and employers can be somewhat difficult. Many people end up paying higher taxes than necessary because of a lack of proper knowledge on how to reduce their taxes during the preparation of the returns.

Steve @ 2012 to 2013 Taxes writes Tax Tips By Consumer Reports On Lowering Your Expenses – Filing of federal income tax returns by businesses and employers can be somewhat difficult. Many people end up paying higher taxes than necessary because of a lack of proper knowledge on how to reduce their taxes during the preparation of the returns.

Jon @ Novel Investor writes Roth IRA Rules: Everything You Need To Know – The Roth IRA has its advantages. But is it a good fit for you? This guide covers everything you need to know about the Roth IRA rules and more.

Alexa @ Single Moms Income writes Tips from an Insurance Agent: How to Really Save Money on Insurance – I have been an insurance agent for a little over a year now. Even though I sometimes complain about my job, I promise you, I know personal lines insurance like the back of my hand.

Alexa @ Defeat Our Debt writes How to Pay Off Payday Loans and Credit Card Debt – It is not uncommon to fall victim to payday loan scams and credit card debt. It is just so easy to swipe a credit card without even blinking. After quite a few swipes you are unable to pay your bills on time.

Connie @ Savvy With Saving writes How To Save At Starbucks – If I have one vice when it comes to money, it is coffee. While I try to be frugal, I still need my morning cup (or two) of coffee everyday.

Miss T. @ Prairie Eco Thrifter writes How to Bond with Mother Nature – Here are some tips to help you bond with Mother Nature so you can experience the benefits that such an experience can provide.

KK @ Student Debt Survivor writes Drugs & Student Loan Debt – What are the similarities and what do we do to stop the epidemic?

Dividend Growth Investor @ Dividend Growth Investor writes Do not despise the days of small beginnings – In this article I argue why it is important to start investing, even if you have small initial amounts of funds to invest. The most important thing about investing is simply to get started.

Harry Campbell @ Your PF Pro writes Is Going Green Worth It? – I’m not sure what’s so attractive about farmer’s markets but I love going just to check out all the cool vendors, sample food and of course I usually end up buying a ton of stuff. Farmer’s markets in my area have evolved from selling just groceries to all different types of products like cheeses, butter, nuts and even restaurants are getting in on the action now.

Anton Ivanov @ Dreams Cash True writes The Best Finance Books of All Time – This list of the best finance books is a great place to start learning more about personal finance and investing. There is so much to learn from these 10 awesome books!

Harry Campbell @ The Four Hour Work Day writes “Unpaid Vacation vs. Regular Vacation “ – One of the perks of having a day job is getting paid when you go on vacation. Most companies start employees off by giving them 2 weeks of vacation plus holidays but that never seems to be enough. A lot of employers(especially in my field: engineering) are actually starting to give an extra week around Christmas time to New Years since not much work gets done during that time anyways. So that’s about 3-4 weeks of combined vacation and holidays for the average worker.

Jen

Latest posts by Jen (see all)

- New Years Resolutions that Will Make You Richer - January 10, 2014

- Water in Your Basement? Your Foundation Has Been Neglected - January 10, 2014

- Fun Ways to Earn Extra Cash and Bonuses - December 14, 2013

Thanks for inclusion and hosting, I really appreciate it.

Thanks for including my post, and thanks for hosting!

My recent post What to Do With Side Income

Thanks for hosting and including me!

My recent post BI 055: Location Independent in Las Vegas