For the past 3 months, I’ve had a nice chunk of change sitting in my….online savings account. Oh, the my-money-is-doing-next-to-nothing-for-me horror!

Closing Friday; Jetting off Saturday

In June, I sold my condo for $30K over the asking price, thanks to making a great investment in a foreclosed condo three years ago and a bit of luck from the Boston real estate market. When closing came in August, I had bigger “fish to fry” as I was about to embark on my trip around the world. Literally, closing was on Friday and I was set to jet off to Fiji the very next day.

Needless to say, I did little more than transfer the sum of the six-figure check I received at closing from my checking account to my online savings account. Of course, I did have every intention of figuring out what to do with the money as I had downtime during my travels. But as life would have it, I promptly paid no attention to the money and concentrated on fully immersing myself in my adventures; I figured that things would work themselves out when I returned home.

The thing is, I returned home over 5 weeks ago…and the money is still sitting there.

Counting My Blessings

Now don’t get me wrong, I realize that I’m in a very fortunate position. Some people are pinching pennies with a bare bones budget just to get by. Others are drowning in credit card debt. Even more are concerned with various budget-drains such as health crises, unemployment, etc.

And to those people, I say hold on. Stay strong and steady your resolve to reach better days. Remember that after every storm, the sun always returns–and shines just a little bit brighter.

I was there; I know exactly what you’re going through. I know what’s it like to have $1 to my name, to be nearly homeless, and to feel as if your world is closing in around you. Throughout all of the various challenges I’ve faced in my life, one thing remains constant: My positive, can-do attitude has afforded me strength, resilience, and opportunities beyond my wildest dreams.

Looking back at the crazy ride this year (and my overall financial journey) has been, I’m incredibly grateful. If you’re looking for proof that hard work does indeed pay off, take a walk through some of the archives here. Hopefully, you’ll find some inspiration along the way that will help you count your own blessings (and figure out how to turn things around in a positive way).

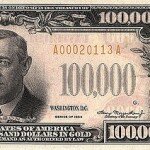

What to Do with $100K?

After some calculations about what I’d like to keep in my e-fund, travel funds, and an extra “I’m a freelancer” cushion, I have roughly $100K to work with. And quite frankly, it still sort of makes my jaw drop to realize that I’m able to type this, let alone make such big financial decisions.

I’ll admit that there’s a large part of me that wants to squirrel this money away in the safest ways possible because it literally represents a lifetime of hard work to get to this point. More than luck with a real estate sale, this money is a testament to how far I’ve come: From the credit card debt-ridden college grad with small town roots to the debt-free woman living in the big city.

But then there’s the flipside…

I’m a personal finance blogger; I should be doing something more with my money! I should be investing smartly and increasing my returns! I need to make my money work hard for me!

Yeah.

What to do with $100K? I’m really not sure. What I do know is that I’m a bit paralyzed from an interesting mix of excitement, fear, skepticism, disbelief, and confusion. I’m not sure if I want to purchase an investment property (I’m purposely renting for the next year as I found an incredible deal that’s allowing me to pursue more lucrative freelancing opportunities without being locked into a Boston-sized mortgage again), invest in stock, hire a financial planner, or just go nuts with CDs and bonds (yay, safety!).

I’d love to hear your suggestions and experiences with investing larger sums of money. What did you/they do? Any specific do/don’t strategies are appreciated! ![]()

What Would You Do with $100K?

Jen

Latest posts by Jen (see all)

- What to Do with $100K? - October 31, 2013

- Nerds, Pull-ups, and How to Network Like a Boss: FinCon13 Recap - October 25, 2013

- Want to Avoid Becoming House Poor? Choose Your Mortgage Wisely - October 23, 2013

I wouldn't worry so much about what other people think. If it were me, though, I'd just send it all to student loans. Sad that this is an option

My recent post Why your significant other’s spending is even more important than you think — especially for millennials

If it was me, I would probably invest it. Since you're self-employed, you can open accounts like a SEP-IRA and a Solo/Individual 401(k). (I don't actually know anything about these other than their names.) I would put as much as I could into those accounts and then invest the rest in a taxable account, according to my Investment Policy Statement (see Bogleheads). If you want to purchase real estate again in the near future, I might keep some of it in cash to help facilitate that. After all, any money you want in the next 3-5 years should be in cash, not in the stock market.

If it were me, I'd put most of it in an index fund and start a home based business, using that money as a cushion until the business got going. I figure if I can live on $25,000/year that's 4 years straight up. If I can run a business from home that makes $15,000/year, that's 10 years of working from home. I'm pretty sure I could do better than $15k/year though.

It's fun to imaging the possibilities, hope you find a good solution!

My recent post What’s Your Favorite Halloween Candy?

Good question! I'd be too scared to invest it in stocks. if CD rates have improved I'd do that but it's been a while since the interest was any good on those. If I know myself it would sit in a bank account somewhere. I have chunks of money stashed in 3 different bank accounts as it is.

My recent post When Are You Going to Cook Something?

I want this problem! hee! I would put it towards retirement if it were me…but that’s because I have a lot of catching up to do. It’s just nice knowing it’s socked away.

hee! I would put it towards retirement if it were me…but that’s because I have a lot of catching up to do. It’s just nice knowing it’s socked away.