For the past 3 months, I’ve had a nice chunk of change sitting in my….online savings account. Oh, the my-money-is-doing-next-to-nothing-for-me horror!

Closing Friday; Jetting off Saturday

In June, I sold my condo for $30K over the asking price, thanks to making a great investment in a foreclosed condo three years ago and a bit of luck from the Boston real estate market. When closing came in August, I had bigger “fish to fry” as I was about to embark on my trip around the world. Literally, closing was on Friday and I was set to jet off to Fiji the very next day.

Needless to say, I did little more than transfer the sum of the six-figure check I received at closing from my checking account to my online savings account. Of course, I did have every intention of figuring out what to do with the money as I had downtime during my travels. But as life would have it, I promptly paid no attention to the money and concentrated on fully immersing myself in my adventures; I figured that things would work themselves out when I returned home.

The thing is, I returned home over 5 weeks ago…and the money is still sitting there.

Counting My Blessings

Now don’t get me wrong, I realize that I’m in a very fortunate position. Some people are pinching pennies with a bare bones budget just to get by. Others are drowning in credit card debt. Even more are concerned with various budget-drains such as health crises, unemployment, etc.

And to those people, I say hold on. Stay strong and steady your resolve to reach better days. Remember that after every storm, the sun always returns–and shines just a little bit brighter.

I was there; I know exactly what you’re going through. I know what’s it like to have $1 to my name, to be nearly homeless, and to feel as if your world is closing in around you. Throughout all of the various challenges I’ve faced in my life, one thing remains constant: My positive, can-do attitude has afforded me strength, resilience, and opportunities beyond my wildest dreams.

Looking back at the crazy ride this year (and my overall financial journey) has been, I’m incredibly grateful. If you’re looking for proof that hard work does indeed pay off, take a walk through some of the archives here. Hopefully, you’ll find some inspiration along the way that will help you count your own blessings (and figure out how to turn things around in a positive way).

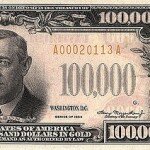

What to Do with $100K?

After some calculations about what I’d like to keep in my e-fund, travel funds, and an extra “I’m a freelancer” cushion, I have roughly $100K to work with. And quite frankly, it still sort of makes my jaw drop to realize that I’m able to type this, let alone make such big financial decisions.

I’ll admit that there’s a large part of me that wants to squirrel this money away in the safest ways possible because it literally represents a lifetime of hard work to get to this point. More than luck with a real estate sale, this money is a testament to how far I’ve come: From the credit card debt-ridden college grad with small town roots to the debt-free woman living in the big city.

But then there’s the flipside…

I’m a personal finance blogger; I should be doing something more with my money! I should be investing smartly and increasing my returns! I need to make my money work hard for me!

Yeah.

What to do with $100K? I’m really not sure. What I do know is that I’m a bit paralyzed from an interesting mix of excitement, fear, skepticism, disbelief, and confusion. I’m not sure if I want to purchase an investment property (I’m purposely renting for the next year as I found an incredible deal that’s allowing me to pursue more lucrative freelancing opportunities without being locked into a Boston-sized mortgage again), invest in stock, hire a financial planner, or just go nuts with CDs and bonds (yay, safety!).

I’d love to hear your suggestions and experiences with investing larger sums of money. What did you/they do? Any specific do/don’t strategies are appreciated! ![]()

What Would You Do with $100K?

Jen

Latest posts by Jen (see all)

- New Years Resolutions that Will Make You Richer - January 10, 2014

- Water in Your Basement? Your Foundation Has Been Neglected - January 10, 2014

- Fun Ways to Earn Extra Cash and Bonuses - December 14, 2013

I wouldn't worry so much about what other people think. If it were me, though, I'd just send it all to student loans. Sad that this is an option

My recent post Why your significant other’s spending is even more important than you think — especially for millennials

I'd definitely do the same if I had them!

If it was me, I would probably invest it. Since you're self-employed, you can open accounts like a SEP-IRA and a Solo/Individual 401(k). (I don't actually know anything about these other than their names.) I would put as much as I could into those accounts and then invest the rest in a taxable account, according to my Investment Policy Statement (see Bogleheads). If you want to purchase real estate again in the near future, I might keep some of it in cash to help facilitate that. After all, any money you want in the next 3-5 years should be in cash, not in the stock market.

Great ideas; thanks, Leigh! I do still have a part-time job that comes with a 403(b), so I max that and my Roth. I think some cash will stay put for more adventures in real estate…

If it were me, I'd put most of it in an index fund and start a home based business, using that money as a cushion until the business got going. I figure if I can live on $25,000/year that's 4 years straight up. If I can run a business from home that makes $15,000/year, that's 10 years of working from home. I'm pretty sure I could do better than $15k/year though.

It's fun to imaging the possibilities, hope you find a good solution!

My recent post What’s Your Favorite Halloween Candy?

That's a great idea! I think I'll stick with making a go at freelancing, but I am investigating lots of other web-based options to round out the mix. Over the next year or two, my focus will be on bumping up the passive income ventures

I love how you've laid out the possibility of a challenge for how much you can live off of–very motivating!

Good question! I'd be too scared to invest it in stocks. if CD rates have improved I'd do that but it's been a while since the interest was any good on those. If I know myself it would sit in a bank account somewhere. I have chunks of money stashed in 3 different bank accounts as it is.

My recent post When Are You Going to Cook Something?

Yeah, stocks scare me too much at this point! I have retirement savings pointed that direction and it's plenty of risk for me to have those target date funds, etc.

I want this problem! hee! I would put it towards retirement if it were me…but that’s because I have a lot of catching up to do. It’s just nice knowing it’s socked away.

hee! I would put it towards retirement if it were me…but that’s because I have a lot of catching up to do. It’s just nice knowing it’s socked away.

I knew it was a bit of a risk writing about this—hoping I don't come off as complaining about such a great "problem!" I'm trucking along just fine in the retirement department, but I would absolutely do what you mentioned if that weren't the case

I would invest the money. You're too young to invest in bonds and CDs.

You're too young to invest in bonds and CDs.

My recent post Back from Monterrey, Mexico

Haha…so true!

What a problem to have. If I had $100k now, I would use it for a down payment on our next home. That would make for a nice mortgage reduction. If it were me a few years ago, I would diversify the money. Keep some for safety, invest most in different risk type accounts. I would want my money making me more money.

Yes! I like both of these ideas–I think that's why I'm so torn. Regardless of what I do, I definitely want my money making me even more money

I’m not entirely sure what the answer is, but I wish I had that problem!

Jaclyn recently posted..Financially Planning for our First Child

Jaclyn recently posted..Financially Planning for our First Child

I would have never thought I would have it–ever! It's still so surreal but I'll take it

Good problem to have! If it were me, plan of action #1 would be to determine an asset allocation. Then, the second and final step would be to just plop that money into the AA, in a tax efficient way (e.g. – bonds in a tax advantaged account first).

Our AA is the Simpleton's portfolio: 25% each in index funds of large US stocks, small US stocks, international stocks, and short term US govt bonds.

My recent post Net Worth, No Auto October, and No Ad November

This is excellent–thank you! I absolutely need to figure out the allocation strategy that makes sense for me.

Use Jemstep — they'll help you! Also find an interest-bearing checking account, at least. Also try out some of these investing things — there are so many that will be super un-intimidating. Invest in dividend-paying things! I have all the ideas!

My recent post

Love it! I am researching options like Jempstep–I'm just not sure where to start. Slowly but surely, eh?

That is definitely a great position to be in Jen. The beauty is that you can take your time with it. At the end of the day, you need to do what's best for you and your situation. If you do go the investment route, then I'd avoid a financial planner as they'll generally take a good chunk of fees. You could go with some solid index funds and have little cost involved.

If it were us, I think we'd split it up some. I'd put a chunk away for a down payment so we could upgrade and get an actual office again – as opposed to our dining room table. I'd take the other portion and split it between going into our SEPs and the other part would be something business related to add to our business. Good luck with the decision!

I'd take the other portion and split it between going into our SEPs and the other part would be something business related to add to our business. Good luck with the decision!

Thanks, John! The time piece is important for me to remember–I sometimes tend to want to make decisions quickly and this is definitely one that shouldn't be rushed.

I'm part of the dining room table crew now that I moved!

Now that you have some experience in real estate, it could be sensible to reinvest here (depending on your other existing investments and net wealth regarding diversification).

My recent post 2014 goals – New Year’s resolutions come early

Yes! This is what I'm leaning to the most; I just need to figure out where to start searching for my next property.

I’d probably put it in some vanguard index funds, but since you’re freelancing it might make sense to put a bunch in a SEP IRA that should also help lower your taxes this year…

Mrs PoP @ Planting Our Pennies recently posted..Happy Friday – Happy Money: Buy Time

Mrs PoP @ Planting Our Pennies recently posted..Happy Friday – Happy Money: Buy Time

Thanks, Mrs. PoP! I'm covered in the retirement department, but I do like the idea of some index funds. So many choices!

Awesome work Jen!!! That hard work has paid off. I am in a very similar position myself. First off I have to say I'm blessed to have been given the opportunity to be a steward such amount of money… I have actually recently been able to help out some close friends of mine who were struggling and had some unexpected hurdles thrown at them in life…

I felt very humbled to step in a provide them with some assistance and I asked for nothing in return. I am still working my way to a million….. but along the journey I think it is only prudent to stop and look around and help those around you in need with which you can impact their lives.

I'd like to hear more thoughts on your choices of passive income as that is the path I have been heading towards but don't seem to be getting there very fast. I currently still work for someone else, but I stuck with that while they were finish up paying for my grad school. Now that is all said and done …. My options are open and I'm seriously considering the transition into the self employed realm… I just really don't know where to start that venture.

I have enough finances to cover my current expenses for about 8 years if I didn't make another dime… which given my ambitions and goals I know I'll find a way to make money in one form or another.

Wow, Tim–this is awesome!!! First of all, congratulations on your success. It's an amazing feat to get to the point where you are now, let alone where you'll be in the future.

I'm currently writing a whole series of posts about passive income because that is the route for me. I also am having a slow go of it, but I also don't mind taking the scenic route so that I can identify the best option for me. Hopefully these future posts will be helpful!

You are a great friend to help those people out–I'm sure they appreciate it more than you know

Consider yourself very blessed to have this "problem." It's an awesome situation to be in. Whatever you decide, there is no need to rush. Make sure the decision fits right for you. In this order I'd focus on: emergency fund, paying off any debt, setting up a retirement fund, then investing the rest in low cost mutual funds or index funds.

It's an awesome situation to be in. Whatever you decide, there is no need to rush. Make sure the decision fits right for you. In this order I'd focus on: emergency fund, paying off any debt, setting up a retirement fund, then investing the rest in low cost mutual funds or index funds.

My recent post How One Shoebox Can Change A Life This Christmas

Absolutely! While I've always hoped to figure out a way to be more financially free, I never thought it would happen like this or this soon. Thank you for the ideas!

Is dump it all in Apple stock and NLY, a mortgage REIT! I think you’re still in your 20s right?

Do you have other assets and investments or is $100k the grand total?

If I could rewind 10 years id take more risks with investments.

Good luck!

Sam

Financial Samurai recently posted..Should I Ask Someone For Their Credit Score Before Getting Into A Serious Relationship?

Financial Samurai recently posted..Should I Ask Someone For Their Credit Score Before Getting Into A Serious Relationship?

Thanks, Sam! This $100K is in addition to my emergency fund, retirement savings, and a few other investments. It's basically what I have to "play" with right now. Apple stock…Oy!

Since you’re asking what I would do, I woukd pay off all of our non mortgage debt, take a week off work with family (nothing too elaborate, maybe short road trip) rest in savings for next downpayment.

If u were you, I’d hire jeff rose and ask him lol.

catherine recently posted..Defining Emergency

catherine recently posted..Defining Emergency

Hahaha…love it! I should definitely send a note his way…

A few years ago I would have told you to buy an investment property. But now I feel my rentals are tying me down and I would love to have a maintenance-free investment in their place. I am tired of chasing deadbeat tenants, dealing with property management companies that move too slow to rent my properties, and getting repair calls when I am traveling… not to mention the added expense from unnecessary wear and tear. For example, tenants don't change air filters. I don't know why that is so hard – I even provide the filters free of charge.

If you value being able to go anywhere, and I think you do since you took that trip not long ago, why not stick to investments you can manage entirely from a computer?

My recent post Mystery Shopping Road Trip: Post Mortem

Thank you! What you wrote about your properties is precisely the reason I haven't jumped into investment properties yet and why I decided to sell my condo rather than hold it and rent it out. It's really scary to think of all the things that could go wrong!

I absolutely value the freedom to pick up and go wherever–thanks for the reminder

Interestinly, I rented my property, and it's been smooth sailing to date – just depends on the tenants, as much as the agents you use. I had about $100 k deposit before I bought it's what you need to get a home loan here in Australia. I feel better having it in a 'house' to be honest, with rent paying the mortgage. It's a 'roof over my head' if I can't rent, and it'd be 10 months before my bare bones budget and savings ran out, so in that time I would hope I could sell it for the same as I bought it two year ago, at least.

First, congrats on that awesome stroke selling the house and making that huge chunk…its certainly a nice place to be financially. What to do with it, at the end of the day, its up to you, if it were me though, I'd plonk it down into investments, mostly index funds or even a property if I had the guts to pull it through and the patience to wait for the investment to mature.

All the best whatever you decide.

My recent post Scotiabank Gold American Express Credit Card Review

Thanks, Simon! So many options to choose from–I'm so lucky indeed!

Without a doubt, I'd put it towards our mortgage. That would get us to about 1/2 paid off. Seeing as you don't have that to worry about right now, I'd say save 1/2 and use the other 1/2 on something you need/really want/will improve your life. That way, even if you make the "wrong" decision with $50k, at least you'll still have $50k working for you. What do you think?

My recent post States Where You Can’t Be an Amazon Affiliate

Wow, I love this idea!!! What a neat way to think of it. I didn't use a penny of this money for my trip, but I would like to invest and know that I'll most likely learn as I go. Seems like $50K would be a good way to gain the necessary knowledge/experience. Thanks, Lena!

That is a glorious problem to have and I totally understand the need to hang onto that money, even if it isn't making any money for you. If I had no debt, I would put half into a broad index fund and half into purchasing a rental property. Boring, but that's how I roll!

Boring can be GOOD! That's apparently how I roll, too…hahaha

It all depends what you would like to do over the next few years. My guess is that you will consider buying a home again within five years… likely before then. If that's the case, you probably want some not-too-risky investments for your money. Otherwise… personally, I would probably dump it all into registered accounts and invest it, setting up DRIPs for anything that has dividends. Then, consider your retirement rather well funded I would only buy 4-6 stocks or ETFs total. Maybe keep some in cash or near-cash in case an opportunity shows itself.

I would only buy 4-6 stocks or ETFs total. Maybe keep some in cash or near-cash in case an opportunity shows itself.

If your goal is to be financially independent, or close to it, go for dividend stocks or another cash-generating investment. Then don't take the money to live on unless you need it, let it grow.

This is awesome advice; thanks, Anne!!

The advice to consider investing a portion of it, but not all of it, is good advice. I prefer mutual funds and the Vanguard fund family in particular. But while you're figuring out what to do with it, you might look at putting your money in a safe, interest bearing account. Discoverbank.com will give you .8% in their online savings account, no fees, no obligation while you're deciding.

That’s a great idea! I’m in an Ally account now, which is at least earning something and is safe. I need to really make some decisions before the end of the year!