Life certainly has a way of working itself out lately–as does my budget. Just as I recently posted about why I’ll never regret a dime I spend on vacations, I go ahead and spend a ridonculous amount of money to extend my most recent trip to Kauai, nearly pushing myself into the “Piss, what have I done” vein of disbelief.

But even after filling in all of the (very ugly) numbers in my spreadsheet, I have to admit that I sit here typing this post with a huge shit grin on my face after returning from a pretty epic island-hopping adventure.

Vegas or Bust–$1K in Flight Changes

Originally, I was supposed to be flying to meet my BF in Kauai after he’d been in Vegas for a conference. After working my tail off to find a pretty amazing combination of deals that scored me a cheap R/T flight from Boston, I realized that the dates conflicted with some project and work responsibilities–after I had already booked the non-refundable flight combo on Expedia.

A quick snap of the Vegas Strip

Cost to fix my oversight? A cool $1K in flight changes.

At the end of the day, I realized that the work I had to do was worth far more than the initial bite of the flight extravaganza, so I finagled a series of flights that would allow me to be in Boston a few days longer and also visit my BF in Vegas thanks to a 3.5 hour layover. After running through the airport Home Alone-style and grabbing a cab, I met him and his colleague for a quick round of drinks atop the Cosmopolitan hotel, which was a nice way to kick off the vacation.

Kauai Turns into Maui which Turns into Oahu

For the next round of could-have-been-completely-avoided-had-I-planned-better expenses, the adventure began in Kauai, where I originally had planned to spend a three-day long weekend. When I got there, I fell in love with the island, and I was relishing the time with my BF as we hadn’t seen each other much lately due to his crazy work travel schedule. After a few days on island time, I decided to continue the adventure rather than head home (he originally had planned to continue on to Maui to meet up with a friend while I would come back to Boston).

Cost to extend my vacation to include Maui and Oahu? Another ~$600 (I was able to use some of the credit I had from cancelling my initial flight to Kauai which saved me from dropping another $700 or so). But as you can see from my pictures here, it can be hard to leave paradise when you’re there and know you have an option to stay longer:

Walking along the private beach where we stayed in Kauai

Caves we found while exploring Kauai

View from our sunset catamaran tour in Kauai

View from Kauai Helicopter Tour of Na Pali Coast

View from Kauai Helicopter Tour of Na Pali Coast

Sunrise view from our balcony at the Maui Marriott Ocean Club

Waterfall on Road to Hana in Maui

If Headed to California, Why Not Stop in Napa?!

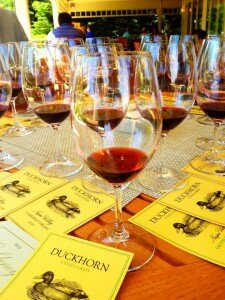

On the way home, we also decided to stay an extra day in San Francisco, which necessitated a trip to Napa again for some wine tasting. ![]()

Duckhorn Vineyards Napa CA

In total, I spent just about $3K on this trip. While that’s a nauseating sum considering at least $1,500 or more could have been avoided had I done a better job planning, I’m still in the camp of not regretting the decision to stay longer. Flight delays and extra expenses be damned; we had a hell of a good time!

That being said, I have my work cut out for me to save up and find creative ways to cut expenses for our upcoming trips to Quebec and Portugal….

Financial freedom–a term tossed around quite a bit in the blogosphere, among money experts and an elusive “holy grail” for many people. It’s a concept touted on websites and in books alike–the idea that one day, after enough hard work, we can all live a comfortable life with little worry about finances.

Financial freedom–a term tossed around quite a bit in the blogosphere, among money experts and an elusive “holy grail” for many people. It’s a concept touted on websites and in books alike–the idea that one day, after enough hard work, we can all live a comfortable life with little worry about finances. With Valentine’s Day just over a week away, I have some work to do in the gift-giving department. Being the budget-loving, money-saving gal I am, I will definitely be utilizing a hefty dose of creativity to ensure I don’t break the bank for my “favorite” Hallmark Holiday.

With Valentine’s Day just over a week away, I have some work to do in the gift-giving department. Being the budget-loving, money-saving gal I am, I will definitely be utilizing a hefty dose of creativity to ensure I don’t break the bank for my “favorite” Hallmark Holiday.